Our Operations | What we do

The Perpetuals.com Group is operating two main business lines:

1. Kronos X® Multi Asset Exchange Platform

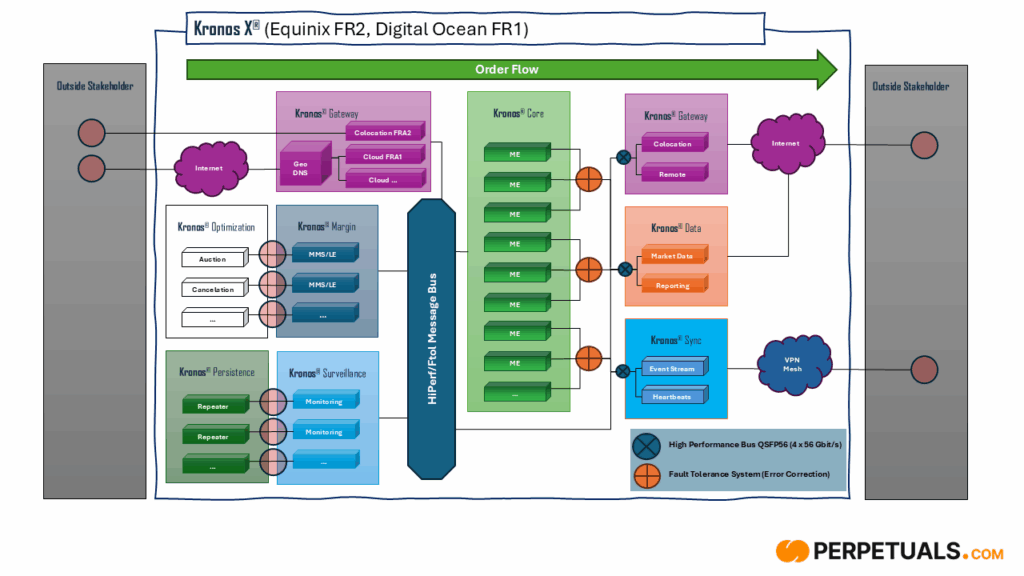

Kronos X® is a proprietary Multi Asset Exchange software and blockchain-based settlement solution that merges the traditional financial market regulatory framework with blockchain and crypto technology.

The platform is specifically built to operate:

EU Multilateral Trading Facility (MTF)

MiCA MTF

DLT multilateral trading facility (DLT MTF)

DLT settlement system (DLT SS)

Product Issuer for Derivatives and Tokenization (Stocks, Bonds, Structured Products etc.)

Self-clearing on an internet 24/7 blockchainMain Products:

24/7 Crypto Spot trading

24/7 Derivatives (Perpetual Futures, Futures, Options, Swaps) for Crypto and other Assets

24/7 Tokenized Assets Issuance and Trading

24/7 Structured Products

24/7 Pre-IPO Contracts/Stock Token

Self-Custody Crypto Wallet with dedicated private/public key pairs per clients

Margin Crypto Wallet with dedicated private/public key pairs per clients

Kronos X® is offered exclusively as a SAAS solution, operated from our financial market infrastructure at the Equinix FR2 data center in Frankfurt, Germany—the same facility hosting Eurex and Xetra primary back-ends.

Our infrastructure is designed for low-latency, high-frequency applications and complies with all relevant financial market and IT regulations including MiFID II, DORA, GDPR, EMIR, MiFIR, and MiCA. This turnkey solution enables FinTech companies and financial market providers such as CFD brokers to become “crypto ready” by adding crypto wallet features and trading of crypto spot and derivatives to their offering.

(Most of the mentioned services and products are operated or planned to be operated by PM MTF Ltd., which operates an MTF under CySEC Licence Number: 458/25).

2. AI-Powered Risk Intelligence & Prediction Markets

Perpetuals.com has developed a novel AI system using machine learning to identify trader behavior at the user account level in real-time. Based on millions of trade records across different asset classes, our model predicts win/loss probabilities for new trades as they occur. This technology serves multiple applications:

– For Product Issuers: Determines hedging requirements (A-Book vs. B-Book) and optimizes trading strategies in real-time

– For Customer Protection: Warns clients before entering financial transactions with low probability of success

– For Risk Management: Optimizes hedging and capital allocation decisions based on trade/counterparty risk profiles

Building on this AI foundation, we are developing an alternative prediction market that will fundamentally disrupt the current landscape. Unlike gambling-like unregulated prediction services that leave clients unprotected, our AI-powered prediction market will offer unprecedented client protection while maintaining the engagement of prediction trading. This product is planned for public announcement in Q2 2026.

We additionally operate financial market issuance – structured products and options in particular – on crypto derivative markets and in tokenized form. We also issue tokenized instruments such as stocks, other real-world assets (RWA), and leverage tokens. Our proprietary AI technology is integrated into our risk management system to optimize hedging and capital allocation decisions based on the probability and risk profile of each specific trade and counterparty.