INTRODUCING BARRIER FUTURES

Defined Risk. Unlimited Potential. Total Control.

Barrier Futures are MTF-traded regulated futures contracts with mandatory stop-loss and optional take-profit and expiration, combining the power of leveraged trading with absolute risk certainty. Every position has a defined maximum loss from the moment of entry: no liquidation surprises, no margin calls, no funding fees draining your account. By building risk management directly into the product, Barrier Futures let you focus on opportunity — not anxiety — turning leveraged trading from a gamble into a calculated decision.

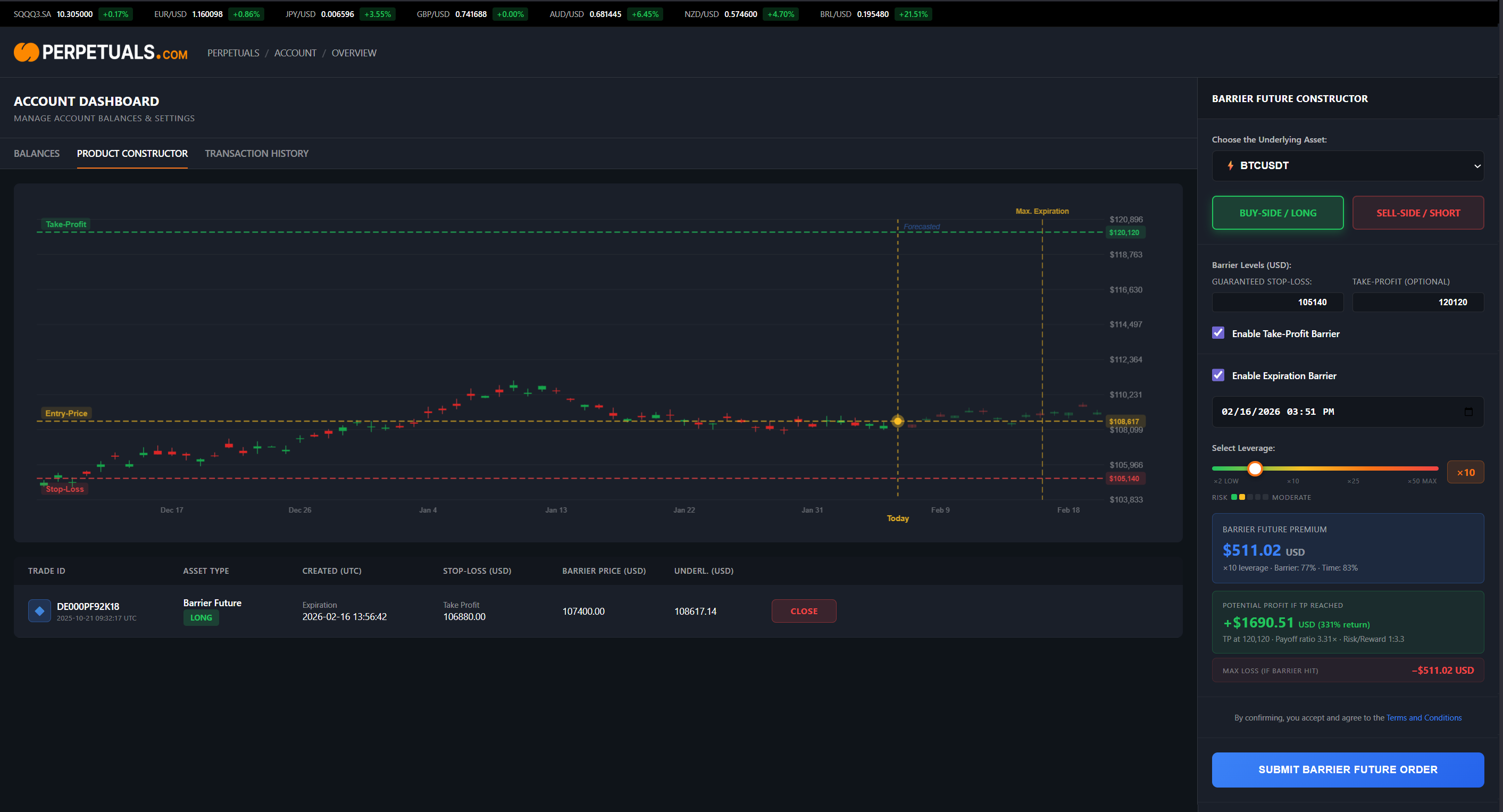

Example Broker Implementation

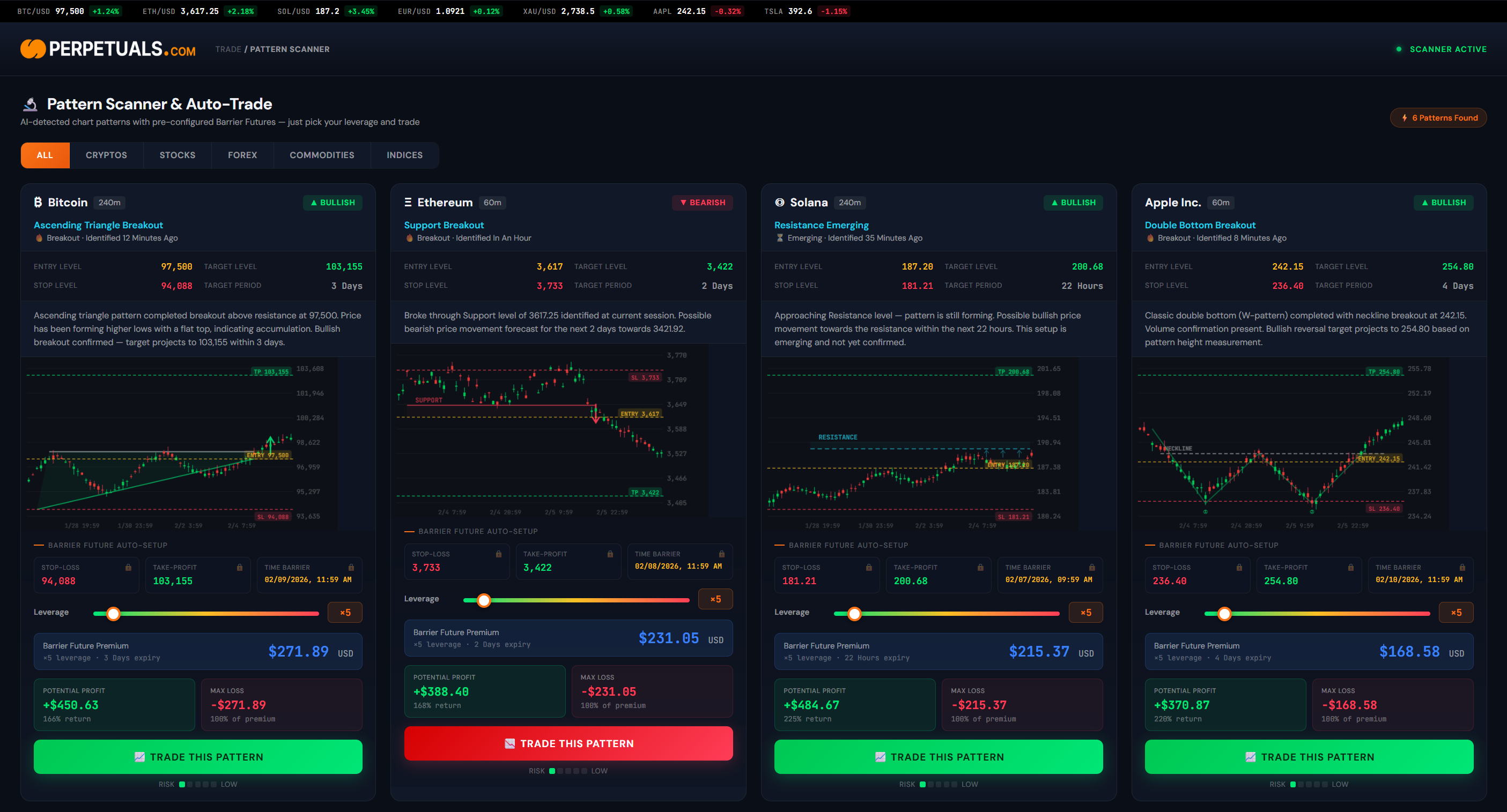

Example Integration into a Pattern Scanner

The integration of Barrier Futures into a pattern scanner system like in this example allows users to trade chart patterns with a single click.

Stop Liquidation Hunters.

Protect Your Position.

On traditional exchanges, your liquidation levels are public data — visible on heatmaps, scraped by bots, and exploited by sophisticated traders who deliberately push price into liquidation clusters. Barrier Futures eliminate this attack vector entirely.

Benefits for Brokers and Financial Services Providers

Add leveraged crypto, commodity and stock trading to your platform without building margin infrastructure. Barrier Futures are MTF-regulated derivatives with built-in risk management — your clients get the leverage they want, you get calculable exposure and stock-simple integration. No liquidation engines. No insurance funds. No 24/7 risk operations. Just connect, offer, and grow.

Integrate as easily as equities — standard order placement, no complex margin websockets or funding rate streams

No liquidation engines, no margin monitoring systems, no maintenance margin calculations to build or maintain

Skip the 6-month development cycle for margin systems — go live with leveraged products in weeks

Offer clients a fully licensed, MiFID II-compliant trading venue — not offshore derivatives

Every position's max loss is pre-funded — no balance sheet exposure from fund depletion

Clients who don't get surprise-liquidated stay clients — improved LTV and retention

Time-based barriers enable trading competitions, prediction challenges, and event trading

Shareable trade setups with referral tracking — every trader becomes an acquisition channel

Positions close at defined levels, not in domino-effect market crashes

Offer Barrier Futures under your brand with full regulatory coverage

Position risk is defined at entry — no overnight teams watching margin levels or triggering liquidations

Stand apart from competitors still relying on unregulated perpetual venues

Benefits for the Clients

Trade with leverage. Know your risk. Always. Barrier Futures are regulated derivatives with built-in risk management — your maximum loss is defined before you enter, not discovered after you're liquidated. No funding fees draining your position. No margin calls in the middle of the night. No liquidation roulette. Just clear, transparent, controlled trading with the upside you want and the protection you need.

Your maximum possible loss is defined before you trade — no surprises, no uncertainty

Your stop-loss executes at your level, not at whatever price the liquidation engine achieves

No 8-hourly funding rates silently draining your position over time

Your position is fully funded at entry — sleep without worrying about margin requirements

Trade on a licensed MTF under MiFID II with real investor protection and segregated funds

Optional expiration lets you hold indefinitely or set a defined trading window

Set your target and the position closes automatically — no need to watch charts 24/7

Access meaningful leverage while maintaining complete control over your risk parameters

One-click setups for technical patterns — Head & Shoulders, flags, stars, and more

Share your trade setups via referral links and earn when others copy your trades

Time-based barriers perfect for earnings, FOMC, ETF decisions, and news events

Clear rules, defined outcomes — no hidden mechanics or complex funding formulas

Defined risk trading.

Engineered for reality.

Engineered for reality.

Barrier Futures deliver what perpetual futures never could: absolute certainty about your maximum loss before you enter a trade. Unlike traditional leveraged products that liquidate positions unpredictably during volatility, Barrier Futures build risk management directly into the instrument itself. Every position has a mandatory stop-loss barrier — your exit level is guaranteed, not hoped for. By combining MTF-regulated execution with optional take-profit and expiration barriers, traders gain the leverage they want with the protection they need. No funding fees. No margin calls. No liquidation cascades. Just clear rules and defined outcomes.

"The derivatives market was built on complexity that benefits intermediaries, not traders. We asked a simple question: what if risk management wasn't an afterthought but the foundation? Barrier Futures are the answer — a product where knowing your worst-case scenario isn't a feature, it's the entire point. We're not optimizing the old model. We're replacing it with something that finally puts the trader in control."

Built for control

Built for control

Barrier Futures were designed for traders who deserve to know their risk before they take it. Every feature, from mandatory stop-loss barriers to optional take-profit and expiration levels, reflects our belief that risk management shouldn't be an afterthought bolted onto complex derivatives. Whether you're a first-time trader seeking leverage or an institutional desk requiring regulatory compliance, you deserve instruments where the worst-case scenario is defined at entry — not discovered during a liquidation cascade.

We've spent years building and operating an MTF and watching retail traders get liquidated at the worst possible moments — wiped out by volatility spikes, funding rate bleeds, and cascade effects they never saw coming. That experience taught us what matters: defined risk before execution, guaranteed exit levels, and product design that protects traders from the mechanics that historically worked against them.

At Perpetuals.com, we don't believe leveraged trading should mean unlimited downside risk. Traditional perpetual futures were designed for exchange profitability, not trader protection — with funding rates, insurance funds, and liquidation engines that extract value at every turn. Barrier Futures flip this model entirely: your maximum loss is locked in the moment you enter, funded upfront, with no margin calls, no funding fees, and no liquidation surprises.

This is a product built by operators who've seen what happens when complexity serves the house instead of the trader. No hidden mechanics. No fine-print gotchas. No "it depends on market conditions" when you ask about your risk. Just a regulated instrument on a licensed MTF where the rules are clear, the outcomes are defined, and the trader — finally — is in control.